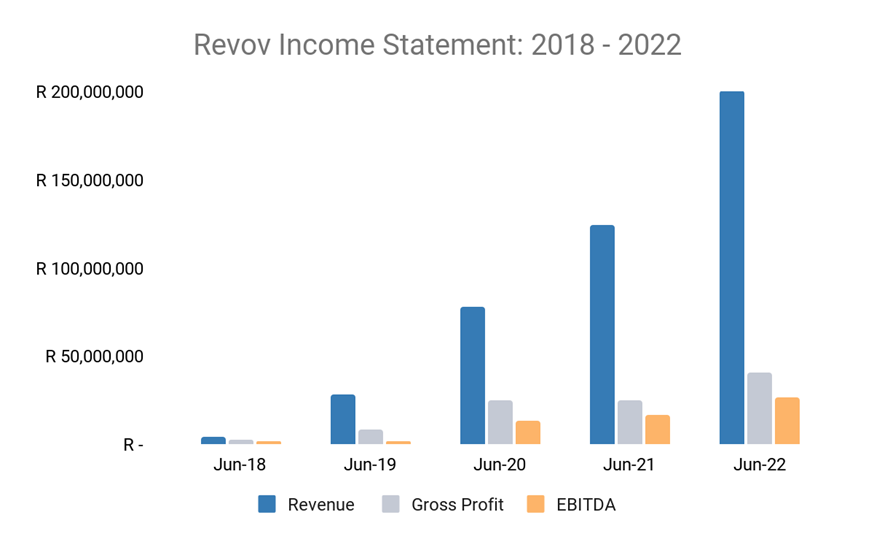

Revov Batteries is a South African Lithium-ion battery company based in Johannesburg, and is the only distributor of repurposed Lithium Iron Phosphate (“2nd LiFe”) battery systems in sub-Saharan Africa. Three years ago, the company booked less than R5m in revenue, and now, the business projects over R200m in new and repurposed battery sales for their 2022 financial year.

Revov has achieved this outstanding growth through a combination of hard work, a bit of luck and three key factors:

- A great product

- The combination of a technical and a sales-focused founder

- Access to capital

The Missing piece:

Energy storage is an integral part of commercial, residential and industrial-scale alternative energy because wind and solar power are not available 24/7. The high cost of lithium-ion batteries has been a barrier to the widespread adoption of renewable energy. It is the same reason that people opt for noisy and smoky diesel generators for their backup-power protection from load shedding.

In late 2016, Lance Dickerson and Felix von Bormann, two telecoms engineers, began working on an innovative plan to reduce the cost of lithium-ion batteries. The batteries in an electric vehicle only last a few years before they start to deteriorate and stop generating enough power to justify their weight in the vehicle. However, if weight is not an issue, as in stationary power applications, the cells can operate for a further 15 years. Revov’s “2nd LiFe” batteries can be configured to perform at the same levels as new lithium-ion cells and have a substantially lower carbon footprint. Revov’s products complete the renewable energy value chain by providing lithium-ion storage at a substantially lower cost.

The Hacker, The Hustler and The Hipster

Silicon Valley investors love to describe the ideal management team as the combination of a technological visionary (“hacker”), a guy who sells things and gets stuff done (“hustler”) and someone who can design stylish products (“hipster”). Felix and Lance had the first two positions covered but needed to engage with outside consultants and experts to get the product design right. A turning point came in mid-2019 when Revov settled on a standardised look and feel for their products. A red star logo, elegant yet robust design and functional user interface make Revov’s batteries instantly recognisable regardless of the battery model.

The Rocket Fuel

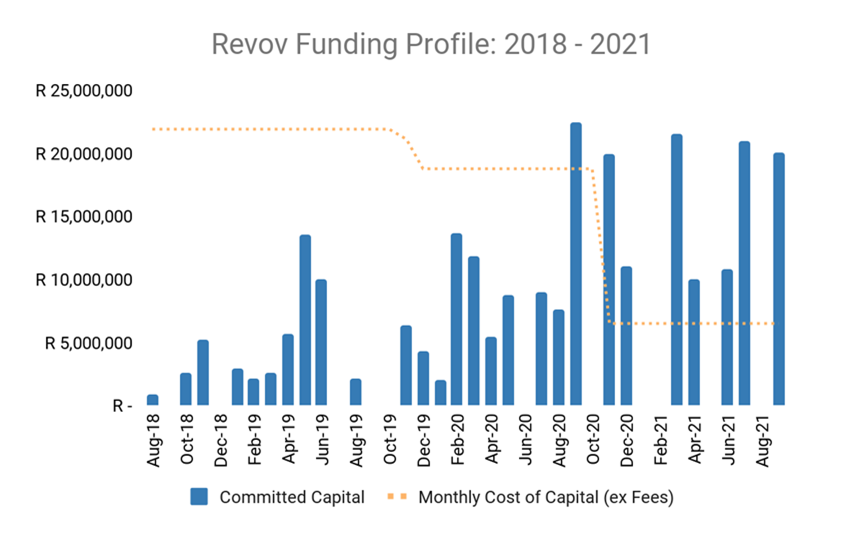

Revov’s market-beating product and a brilliant team would have come to nothing if the company wasn’t able to finance their working capital-hungry and rapidly expanding business. The solution came in an innovative trade finance and working capital solution provided by Louw & Company. The earlier, higher-risk transactions were financed on a partnership basis using Louw’s own capital and a network of co-investors. As the business achieved scale and de-risked, Louw switched the source of the financing to institutional investors. This allowed Revov to access low-cost financing directly from the capital markets without going through the banks.

“We knew from our international colleagues that there is a huge premium on businesses that have compelling stories and strong revenue growth,” said Andrew Louw, director of Louw & Company. “Revov already had the story; we just needed a way to finance the growth. In the beginning, this meant sacrificing profits to access capital, but once Revov achieved scale, we were able to optimise the financing mix and turn it into a highly cash generative business.”

“We backed ourselves and our product and realised that if we were able to take a longer-term view, that we could build a truly incredible business. Although it feels like a lifetime of hard work and challenges, we’ve actually been able to achieve scale in a relatively short period of time. We feel that we are well positioned and through Louw & Company and Moore we are well supported to grow Revov into a billion-rand company” said Lance Dickerson Co-Founder and Director of Revov Batteries.

At Moore, we pride ourselves on walking the entrepreneurial journey with businesses and assisting them to navigate their way through the various challenges which present themselves. Should you require any working capital and / or funding assistance please contact your local Moore firm.