South Africa's natural gas sector faces a critical juncture and is heavily reliant on dwindling imports from Mozambique's Pande and Temane gas fields. Sasol's impending cessation of gas supply by mid-2027 threatens to strand the country's industrial and reticulated base, emphasising the urgency of addressing this looming "gas cliff". Natural gas demand significantly surpasses supply, with substantial increases projected across industrial, gas-to-power, and logistics sectors.

Current Supply Dynamics

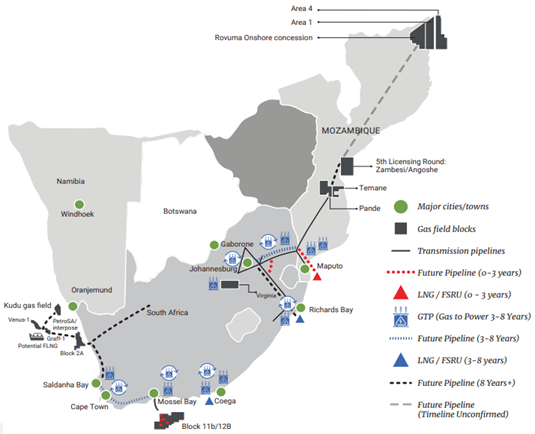

South Africa's primary natural gas supply originates from the Pande and Temane fields in Mozambique, transported via the ROMPCO pipeline to the country. Sasol and Egoli Gas subsequently distribute this gas to both industrial and residential consumers. However, with 75.91% of reserves already depleted, gas production is projected to decline from 2026. Consequently, Sasol, the sole importer of natural gas in South Africa, has informed gas users of an impending cessation of supply by mid-2027. As of December 2023, an estimated 707.85 petajoules of recoverable reserves remained.

Domestic natural gas production is currently limited to Renergen (Tetra 4), which has been producing small quantities of gas for the compressed natural gas (CNG) market and liquefied natural gas (LNG) for industrial customers as part of its initial phase. Renergen's second phase, anticipated to commence in 2027, involves expanding well drilling and gas infrastructure to yield approximately 12 petajoules of LNG annually.

South Africa's energy sector faces the significant challenge of a potential gas shortage looming in mid-2027 as Sasol will need to prioritize its own needs, leaving the South African industrial and the reticulated base stranded. The warnings of a potential “gas cliff” have been in circulation for years, and therefore is expected. Given this context, it is crucial to understand the current and future demand dynamics that emphasize the urgency of addressing the natural gas supply gap.

Source: IGUASA 2023 Annual Report

Current and Future Demand Dynamics

South Africa's natural gas demand is currently around 393 petajoules per annum (PJ/a), with only approximately 190 PJ/a being supplied. The Industrial Gas Users Association of South Africa (IGUA-SA), and the Integrated Resource Plan (IRP) 2023, project significant growth in demand over the coming years, highlighting a critical supply-demand gap that needs urgent attention.

|

South Africa

Demand (PJs)

|

2023

|

2024

|

2025

|

2026

|

2027

|

2028

|

2029

|

2030

|

|

Industrial

|

190

|

243

|

250

|

336

|

359

|

362

|

364

|

367

|

|

Gas to power*

|

134

|

147

|

229

|

287

|

326

|

458

|

464

|

502

|

|

Logistics

|

3

|

3

|

4

|

4

|

5

|

5

|

6

|

6

|

|

Demand Total

|

327

|

393

|

483

|

627

|

690

|

825

|

834

|

875

|

Source: IRP 2023 and IGUAS-SA Annual Report 2023

*MW provided in the IRP 2023 for Gas to Power rounds and Gas to Power for Eskom converted to PJs using a conversion ratio of 0.031536.

The industrial sector is a significant consumer of natural gas, and its demand is forecasted to increase due to the sector’s reliance on natural gas for meeting its decarbonisation goals in its production processes. The gas-to-power sector is poised for substantial expansion in the mid to long term fuelled by proposed plans to build new gas-to-power capacity as well as the conversion of open cycle gas turbines feedstock from diesel to natural gas. Demand from the logistics sector, including transportation and mining, is relatively modest but growing, reflecting the sector's gradual adoption of natural gas as a cleaner energy source.

South Africa Faces Potential Gas Crisis in 2027

This impending gas crisis threatens to disrupt the economy and industrial stability. The manufacturing sector relies heavily on natural gas for its processes and the industry contributes between c.R300bn and c.R500bn to the South African economy per annum. The industrial gas base also directly employs 70,000 people. The complete halt in gas supply could significantly impact the industrial industries, job security and the economy across KwaZulu-Natal, Gauteng, and Mpumalanga. The potential gas shortage in 2027 extends beyond major industrial users.

While companies like Consol Glass, Illovo, Nampak, and others rely heavily on gas, IGUA-SA warns that hundreds of smaller businesses, hospitals, and approximately 8,000 households would also be significantly impacted by a disruption in supply. If South Africa's gas-to-power projects do not come online as planned, the country could face a significant electricity shortfall, exacerbating the existing energy crisis. These gas projects are expected to contribute up to 7,220 MW of new capacity by 2030, with a critical 3 GW planned for the next few years. Without these contributions, South Africa could struggle to maintain a stable electricity supply, leading to severe load shedding. This scenario would have a detrimental impact on economic growth, as frequent power outages disrupt business operations, reduce industrial productivity, and deter foreign investment.

Future Supply Alternatives

1. Matola Import Terminal Project

The Matola import terminal is being developed by BCG, Gigajoule and Total Energies and will comprise a floating storage and regasification unit (FSRU) that will receive LNG shipments from various sources and deliver regasified LNG (R-LNG) to the South African market via the ROMPCO pipeline. The FID on the Matola terminal is expected in September 2024, and the terminal is expected to start operations by mid-2026 at a capacity of 2m tonnes per annum of LNG (c.97PJ/a). This project represents the most advanced project in terms of potentially supplying gas to the industrial base. The viability of this project will be dependent upon the securing of offtake from the South African customer base.

2. Zululand Import Terminal Project

The Vopak Terminal Durban & Transnet LNG terminal (Zululand Energy Terminal) provides another alternative source of gas for South Africa. The Zululand energy terminal was selected as the preferred bidder for a proposed LNG terminal in Richards Bay. The project is scheduled to start commercial operations in 2027, and be developed in two phases, with Phase 1 involving a Floating Storage Unit (FSU) of at least 135,000m3 and an onshore regasification system with an indicative capacity of 2m tonnes a year (c.97PJ/a). Phase 2 is planned to involve an onshore LNG tank with an indicative capacity of 200,000m3, which would potentially replace the FSU, and increase the total capacity up to 5m tonnes per annum (c.244PJ/a) and is planned to come online as early as 2030. Zululand has issued an EOI for potential customers willing to secure throughput at the terminal, for which terminal tariffs would be regulated by Nersa, in line with its tariff determination guidelines.

The geographical location of the terminal will necessitate the transmission of the regassified LNG via a new gas pipeline which will connect to the existing Lilly pipeline near Empangeni. This will take approximately 3 years to build and, given the time required to build the link between Rompco and Lilly as well as the commercial operations date of the Zululand terminal, this project is a long-term solution to address both inland and regional demand.

3. Block 11B/12B Gas Fields

The Block 11B/12B offshore gas fields in South Africa are forecasted to produce 85 PJs per year. However, the timing of production remains unknown due to uncertainty regarding the development of these gas fields, exacerbated by the withdrawal of TotalEnergies and QatarEnergy International E&P from the project.

4. Block 2A Gas Fields

The Atlantis region will be supplied by Block 2A Field supplemented by RMI4P LNG imports from Saldanha Bay. Currently in the FEED phase, the Ibhubesi Conventional Gas Development (Block 2A) is set to begin commercial production in 2025 with a $1.41 billion investment. The project, operated by Sunbird Energy, involves drilling 14 wells and constructing various offshore structures. Located in Block 2A of South Africa's Orange Basin, it will feature an onsite gas-processing plant to supply gas to Eskom, independent power producers and industrial consumers. Estimated to produce 17.6PJ of gas per annum, it is South Africa's largest independently developed gas initiative.

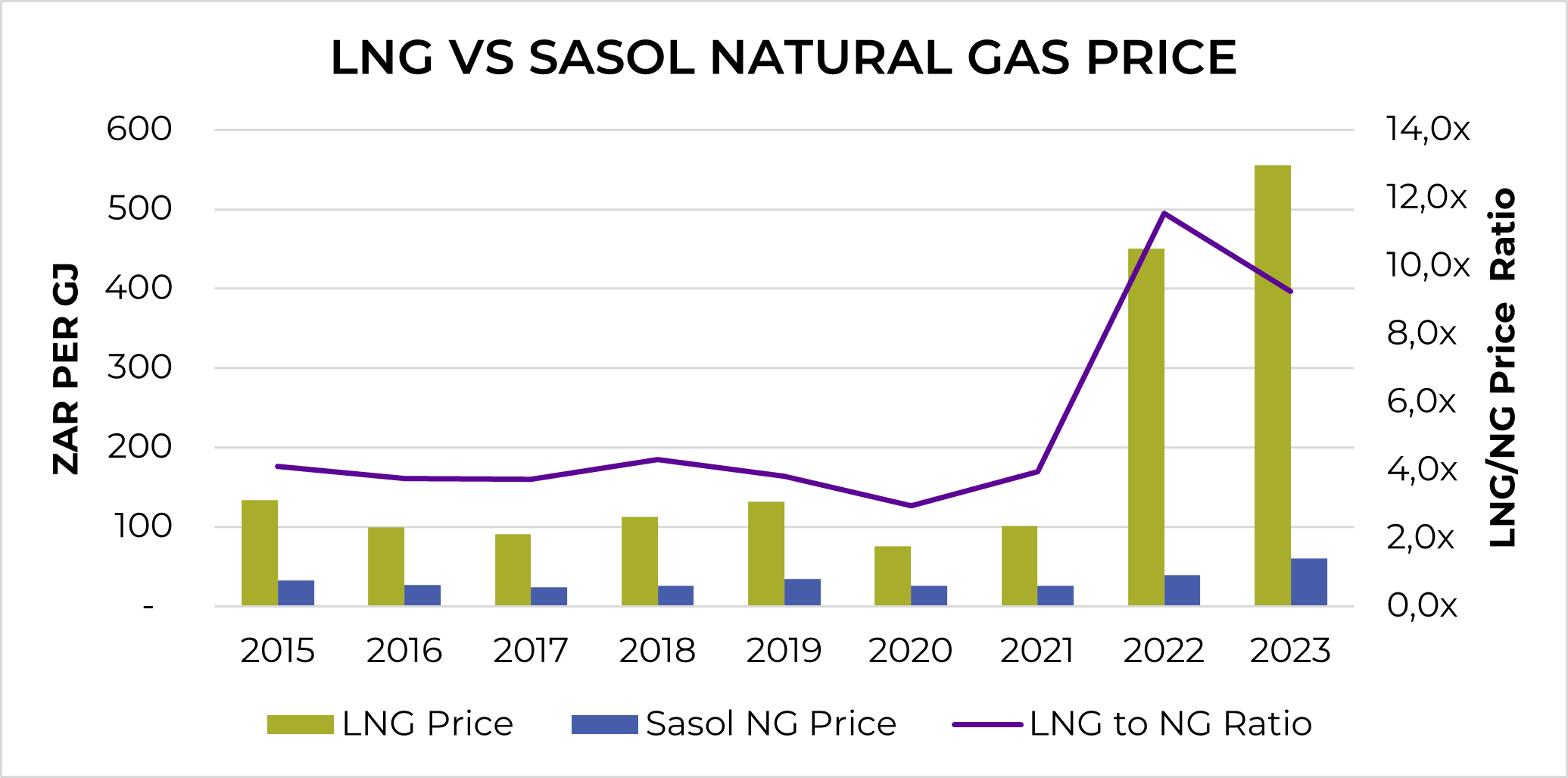

Pricing Considerations

One of the key constraints on the use of LNG as a feedstock for industrial processes is the cost of LNG when compared to the current cost of natural gas. This necessitates a bridge between the price of natural gas and the price of LNG, in order to make the product viable for the industrial gas user base. The cost of LNG will also need to be competitive to alternative fuels such as LPG. This could potentially be done through the government subsidising LNG to alleviate the price gap between NG and LNG, or IGUASA forming a not-for-profit organisation covering the cost of the import infrastructure required to bring natural gas into the country.

Source: Investing.com & SASOL Form 20-F

Government Policy

The draft gas masterplan (GMP) was released in April 2024. The GMP’s key objectives include the following:

-

Ensure that gas supply is secured by diversifying supply options from both local and international markets while minimising the total supply costs and foreign currency exposure.

-

Facilitate an efficient, competitive, and responsive energy infrastructure network (gas storage facilities, LNG import facilities, pipeline network and regasification plants) that will enhance localisation while, at the same time, creating jobs and growing the economy.

-

Identify strategic partners in the South African Development Community (SADC) to unlock local and regional gas demand.

-

Ensure that environmental assets and natural resources are protected and continually enhanced by cleaner energy technologies.

-

Determine resilient gas infrastructure options in the light of demand uncertainties and the possibility of a later transition to cleaner fuels.

The draft gas masterplan has however come under criticism for not addressing the short-term requirements to avoid the pending shortage or detail the roadmap for financing. The recent transfer of gas related legislation and responsibility to the Ministry of Electricity and Energy may unlock more policy certainty in the country.

Conclusion

Comparing the forecasted demand of 875 PJ by 2030, it becomes clear that even with the Zululand and Matola FSRUs and FSUs expected to come online, the capacity may fall short. This necessitates for multiple projects to be developed in time to meet the expected demand, as outlined in the GMP, including additional infrastructure and field developments such as Block 11B & 12B, Block 2A, Tetra 4 and other potential regional fields. Overall, South Africa faces a challenging transition in its gas sector. While the looming gas cliff poses a significant risk, decisive action on infrastructure development, policy implementation and, potentially, price support can mitigate the worst effects and create a more secure and diversified gas market for the future.

Contact your local Moore firm HERE for more information.