Against the backdrop of a decade of operational issues at the coal-powered state utility and the need to reduce carbon emissions in line with the Paris Agreement and the UN Sustainable Development Goals, renewable energy has positioned itself as the proverbial light at the end of the tunnel.

As world leaders met at the 2021 United Nations Climate Change Conference (COP26), most countries, including South Africa, committed to a net-zero emissions future. One of the key strategies to achieving this is to increase the contribution of renewables in the energy mix through the Renewable Energy Independent Power Producer Programme (REIPPPP). Furthermore, South Africa has secured a pledge of R131 billion from a number of Western countries to assist South Africa’s transition from coal.

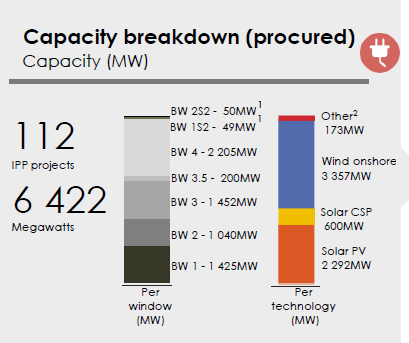

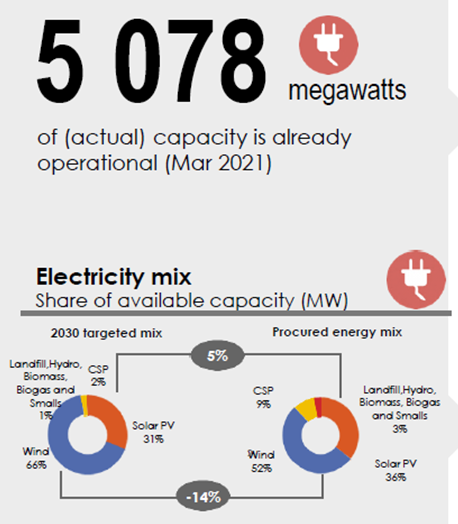

In 2011, the REIPPPP was launched in line with the vision of the Department of Energy’s Integrated Resource Plan (IRP) to increase renewable energy’s contribution to the energy mix and procure 17,800MW of electricity from renewable energy sources by 2030 (onshore wind and solar power). Significant strides have already been made in this regard. As at March 2021, 112 REIPPPP projects with a generation capacity of 6,422MW have been procured over four bidding rounds. Under Bid Window 5, 25 preferred bidders were recently announced for a further generation capacity of 2,583MW.

Source: Department of Mineral Resources and Energy, The IPP Office, March 2021.

Source: Department of Mineral Resources and Energy, The IPP Office, March 2021.

As the renewable energy industry matures, significant decreases in the initial capital costs have been realised due to technological developments and a decrease in finance costs resulting in a decrease in the tariff charged to Eskom by the independent power producers. Bid Window 5 independent power producers winning bids have a weighted average fully indexed price of R0.473/kWh as compared to the R3.03/kWh Bid Window 1 independent power producers contracted tariff. This significant reduction in the cost has resulted in renewable energy tariffs now being comparable to that of nuclear energy (R0.40/kWh). This decrease in costs bodes well for the independent power producers and the Department of Mineral Resources and Energy alike, and the benefit will eventually flow down to the consumer.

There is a strong investment case to be made for REIPPPP projects for both investors and funders alike: stable, predictable, inflation indexed cash flows underwritten by a sovereign guaranteed 20year Power Purchase Agreement (PPA) with Eskom. Recent policy clarity from the South African government regarding the future of REIPPPP projects and the significant reduction of the perceived risk of the renewables industry by lenders (resulting in lower financing costs) have fuelled strong interest in the sector. This has created opportunities to unlock value in the market. This “coming of age” of the industry has created a buzz of recent M&A activity that has, to date, attracted over R41.8 billion in foreign investment.

It is no surprise then that renewables have developed into an attractive alternative asset class, with the emergence of specialised renewable energy funds such as African Rainbow Energy (a venture led by African Rainbow Energy and Power (AREP) and ABSA) and Revego Africa Energy expressing their intentions of listing on the JSE. The sector has also seen the entrance of a few privately-owned empowered investment groups consolidating individual project interests into a portfolio of renewable assets. One of these players, Reatile Group, recently announced a bid to acquire all the issued shares in Hulisani Limited.

With this trend expected to continue following the announcement of the Bid Window 5 preferred bidders, a bright future is in store for SA Inc’s renewable energy industry.

In the next month, we will be looking at key aspects that need adequate consideration when acquiring an equity stake in a REIPPPP project including:

- key due diligence considerations

- key valuation considerations.

For more information on this, please contact your

local Moore firm.